The case titled “Tata Consultancy Services Limited versus Cyrus Investments Pvt. Ltd. and Others”is a significant legal milestone in the dynamically evolving Indian corporate legal jurisprudence. This High-stakes litigation deals with various issues concerning the corporate governance framework, of which the issue concerning the balance between the rights of majority shareholders and the protection of minority shareholders is the predominant issue. In this case, the Hon’ble Supreme Court’s verdict not only interprets and describes legal principles guiding corporate structures but also addresses the broader implications for the corporate landscape in India.

Through this case comment, The author aims to unravel the complexities of this case and recognize its implications on corporate governance, shareholder rights, and the overarching legal framework governing corporate entities in India.

FACTS

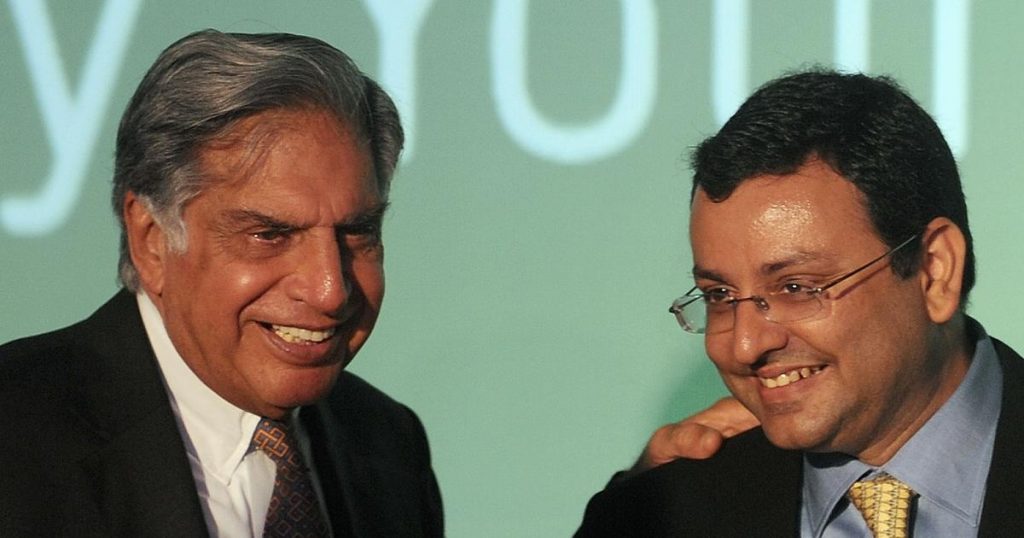

The dispute primarily revolves around the removal of Cyrus Mistry from the chairmanship position of Tata Sons Limited (Hereinafter referred to as TSL). Cyrus Mistry was appointed as Chairman of TSL after Ratan Tata in 2012. However, the relationship between Mistry and the Tata Group soured over time, leading to his unexpected removal from the chairman position in October 2016 and following his ousting, Cyrus Mistry, through Cyrus Investments Pvt. Ltd., which is a shareholder in TSL, alleged oppression and mismanagement by the majority shareholders. Mistry contended that his removal was arbitrary and conducted without adherence to corporate governance norms.

While this issue has already been surrounded, TSL, which was a public company, had converted into a private company. This conversion raised many doubts about the protection of minority shareholders as it was approved by the majority shareholders. Mistry and his group companies opposed the conversion, stating that it would curtail the rights of minority shareholders in TSL.

Mistry approached the National Company Law Tribunal (NCLT), Mumbai, contending that these actions of the shareholders of TSL will come under the purview of oppression and mismanagement under section 241, 242 and 244 of the Companies Act, 2013 and therefore not valid. Against this decision, Mistry approached the National Company Law Appellate Tribunal (NCLAT). NCLAT ordered the reinstatement of Cyrus Mistry as the executive chairman, declaring his removal as illegal. The appellants approached the Supreme Court, contending that it had all the powers to take such a decision and that it cannot be named as oppression and mismanagement under the Companies Act, 2013, and, therefore, the decision of NCLAT should be overturned.

ISSUES RAISED

- Whether the affairs of TSL are being conducted in a manner prejudicial and oppressive to minority shareholders.

- Whether the order of NCLAT to reinstate Cyrus Mistry as the Executive Chairman is valid.

CONTENTIONS

Contentions of Tata Consultancy Services Limited (TCS) and Tata Sons Limited (TSL)

- The appellants contended that the removal of Cyrus Mistry was well within their rights as majority shareholders and in accordance with the Articles of Association of Tata Sons. They argued that Mistry’s removal as chairman was necessitated by a loss of confidence and was a legitimate exercise of their fiduciary duties to protect the interests of the company and its stakeholders.

- They also denied allegations of oppression and mismanagement. They asserted that these decisions were driven by the necessity to protect the interests of the company and to ensure proper corporate governance. Therefore, these actions and decisions in question cannot be termed arbitrary.

- Regarding the conversion of Tata Sons from a public company to a private company, TCS and TSL have argued that it was a strategic decision taken in compliance with applicable laws. They asserted that the conversion was not aimed at stifling minority shareholders’ rights but was driven by the desire to streamline decision-making processes and protect sensitive business information.

Contentions of Cyrus Investments Pvt. Ltd. and Cyrus Mistry

- Cyrus Investments Pvt. Ltd. and Cyrus Mistry contended that the removal of Mistry as Chairman was arbitrary and violative of established corporate governance norms. They argued that the majority shareholders, including Ratan Tata, influenced the decision unfairly, compromising the principles of transparency and fairness in corporate decision-making.

- They claimed that there were many instances of oppression and mismanagement within Tata Sons, which affected the interests of minority shareholders. They pointed to interference in the affairs of other Tata group companies, claiming that such interference compromised the autonomy of these companies and led to flawed corporate governance practices in these companies.

- They argued that conversion into private company was a strategy to limit the rights of minority shareholders. Cyrus Mistry contended that the move was detrimental to transparency and accountability and that it undermined the interests of minority shareholders in contravention of established legal principles.

- They also contended that appointment and nomination processes in TSL were not transparent and that the board’s structure did not reasonably safeguard the interests of minority shareholders.

RATIONALE

Supreme Court, in its judgement in this case, dismissed all charges relating to oppression and mismanagement against TCL made by Cyrus Mistry and others. It underscored the need for companies to function within the Corporate Governance framework under the Companies Act, ensuring that decisions, especially those involving the removal of the chairman and other key executives, are in conformity with the legal provisions governing corporate entities. In this regard, it observed that “unless the removal of a person as a chairman of a company is oppressive or mismanaged or done in a prejudicial manner damaging the interests of the company, Company Law Tribunal cannot interfere with the removal of a person as a Chairman of a Company in a petition under section 241 of the Companies Act, 2013.”

The court recognized the rights of the majority shareholders to make decisions in the best interests of the company. However, it made clear that the exercise of such powers should be fair, reasonable, and within the framework of corporate governance.

While the Supreme Court dismissed the allegations of oppression and mismanagement surrounding the removal of Cyrus Mistry from the position of chairman of TSL, it also acknowledged the existence of various corporate governance concerns within TSL and its group companies. It directed the majority shareholders to safeguard the interests of all stakeholders by addressing these acknowledged concerns.

Also, the Supreme Court examined whether the conversion of TSL from a public company to a private company was in compliance with relevant legal provisions. It acknowledged the right of a company to choose its structure but highlighted that such a decision should not infringe on minority rights. The Supreme Court refrained from interfering in the company’s operations or management decisions. It expressed that courts should not intervene in corporate governance matters unless there exists a clear violation of statutory provisions or actions of the majority that are unfairly prejudicial to minority shareholders.

DEFECTS OF LAW

The judgement by the Supreme Court in the case of Tata Consultancy Services Limited v. Cyrus Investments Pvt. Ltd. clarified many issues surrounding the rights of various stakeholders in the corporate governance framework. However, there are some principles of corporate law that require well-structured legal reasoning and clarification. Some points of law that require further in-depth scrutiny are explained in the below paragraphs.

One of the major criticisms of this judgement concerns the persistent silence of the court in addressing the corporate governance issues within Tata. While the Supreme Court recognized the existence of these issues concerning corporate governance, the judgement somewhat failed to direct the company and its shareholders to rectify those. Also, the apex court failed to provide a robust framework for evaluating claims concerning oppression, which is expected and required to provide greater legal certainty in corporate decisions.

Also, the judgement failed to provide comprehensive guiding principles on standards concerning the fiduciary duties of the majority shareholders. This is particularly necessary with regard to decisions concerning the removal of key managerial persons as it can help increase the accountability standards in corporate governance. The judgement emphasized very little on the issue concerning the protection of minority rights. Supreme Court is required to articulate in much detail the safeguarding of the interest of minority shareholders as it helps in drawing clearer boundaries on the decision-making powers of the majority shareholders. The Supreme Court is also expected to assess the impact of conversion from a public company to a private company on minority shareholders.

INFERENCE

The judgement by the Indian Supreme Court in the case of Tata Consultancy Services Limited v. Cyrus Investments Pvt. Ltd. gave a clear framework for navigating the complex legal landscape of corporate governance practices in India. Mainly, it highlighted the importance of balancing the rights of majority shareholders and minority shareholders while complying with the generally acceptable corporate governance norms and statutory provisions. It also affirms the right of a company to choose its key executives and corporate structure while protecting the minority interest.

It also emphasized various important aspects like limited judicial intervention in internal corporate decisions and improvements in governance structures and practices, which are subjects of widespread discussions around the global corporate community and subjects that require further reforms.

This judgement can be termed as one of the recent landmark corporate legal judgements of the Indian Supreme Court, where the apex court had discussed extensively provisions of oppression and mismanagement under the Indian Companies Act and their applicability in various scenarios. Also, the Supreme Court clearly held in this case that the mere removal of an individual from the position of chairman in a public company cannot be called as oppression when it is not supported by any proper justification. Legal provisions, framework, and judicial decisions concerning corporate governance, rights of various stakeholders in corporate governance and various intricate legal issues surrounding it will continue to evolve, and this decision is a key milestone in this evolution.

Vinay Yerubandi

Damodaram Sanjivayya National Law University, Visakhapatnam