A gift is something that is freely given to someone without expecting anything in return. In Islamic law, there is no distinction between personal and real property. In Muslim law, many scholars view Hiba as an absolute and unconditional transfer of title in an existing property that occurs instantaneously and without stipulation. Gifts are also referred to as “Hiba ” in Islamic law. Hiba is the method of transferring property through the veil of gift. Section 122 of the Transfer of Property Act defines “gift” as the voluntary and unremunerated transfer of any existing real estate, mobile or immovable, from one person to another, the donor to the donee, and the acceptance of the donee or someone acting on their behalf. It is critical that property is transferred voluntarily and without pressure or outside forces. This section addresses in-person gifts or genuine gifts. According to the preceding paragraph, property can be either moveable or immovable, but it must be quantifiable. A physical asset is required to qualify as a lawful “gift” under Mohammedan law. The donation might be cancelled until it is completed. In other words, even if all of the conditions for contributions are met, the donor retains the right to withdraw the offer. The definition of the phrases “gift” and “the topic” has long been a well-known topic that has evolved into a unique area of property law. The basic focus of this research paper is the Property Act’s “gift” provision, how it differs from Mohammedan law, and its repercussions. While the process of enforcing a gift under the Transfer of Property Act is lengthy, it is quite simple under Muslim law (Hiba).

KEYWORDS: Hiba, Muslim law, gift, acceptance, Quran.

INTRODUCTION

Muslim law is a personal law followed by a certain group of people; Muslim law is based on Prophet Mohammed’s teachings and the sayings of the holy book Quran. Muslim law covers all parts of law and is often referred to as “Sharia law,” which is taken from the Arabic word.

According to the case law of Narantakath v Prakkal, the Muslim community is founded on two fundamental beliefs: the belief in one God and the values and mission of Prophet Mohammed. The topic of “Hiba” is the most common topic in Muslim law or Sharia law. Hiba is the notion of “Gift” in Islamic law. The phrase “gift” refers to the transfer of mobile or immovable property from one person to another through the will of one individual, whether written or spoken, without any consideration in return. The Transfer of Property Act of 1882 has no bearing on the idea of Hiba.

Hiba is defined in various aspects of the Indian judiciary; hiba states its rules and basic performance very clearly as being practised by society at large; hiba is a topic that states to gift those properties that are currently in the donor’s possession, and the donor promises to the donee to gift that property to him, and the transfer of the property is effectively made. A donor’s verbal or written promise without any action does not stand hiba. All properties gifted as hiba can be cancelled by the donor even after the item has been transferred. Sunni and Shia laws diverge in their descriptions of the hiba and its cancellation.

HISTORICAL BACKGROUND

Gifts are referred to as ‘Hiba’ in Islamic law. Hiba refers to the manner in which property is transferred as a type of gift. If the transferor is a Muslim and the gift is identified as Hiba, the recipient’s religion is irrelevant. The terms “Hiba” and “gift” are sometimes used interchangeably, but the phrase “Hiba” is only one of the types of transactions protected by the broad term “gift.” A Hiba is a manoeuvre that is performed without thought.

According to Hedaya– “Hiba is an unconditional transfer of ownership in an existing property, made immediately without any consideration.”

According to Ameer Ali– “A Hiba is a voluntary gift without consideration of property by one person to another so as to constitute the donee the proprietor of the subject-matter of the gift.”

According to Mulla – “A Hiba is a transfer of property, made immediately and without any exchange by one person to another and accepted by or on behalf of the latter.”

According to Fyzee – “Hiba is the immediate and unqualified transfer of the corpus of the property without any return.”

RESEARCH METHODOLOGY

The experimental methods adopted in this study are expressive in character. The information was acquired from secondary sources, including journals and articles that were printed in newspapers and websites as well as online. All of the references are properly cited in the bibliography and the footnotes.

LITERATURE REVIEW

- Samarth Trigunayat in his work “Concept of Gift Under Muslim Law” has given a brief compassion of the word “gift” in English and under Muslim Law. In his work, various parts of the gift in property legislation are explored, along with how it differs from the Mohammedan law as well as any repercussions.

- Mayank Shekhar in his work “Hiba – Gift under Muslim Law” has discussed in detail the meaning and essentials of the term “Hiba”. He has briefly discussed about the revocability of Hiba.

- Anuradha Singh in “What are different types of gifts under Muslim law?” has discussed necessary elements of a gift, various categorisation of gift and the concept of Musha has been discussed in detail.

CONCEPT OF HIBA

The term Hiba refers to a gift, and according to Muslim law, gifts can be of two types: constructive and actual. Only the symbolic image of the gift enters into force in constructive, whereas the gift is truly transferred to the receiver in actual delivery.

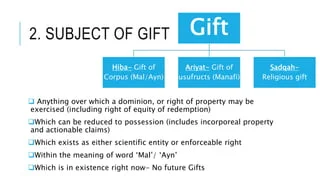

Hiba is a single word that signifies “gift with no expectation of return” (Ewaz). Other types of Hiba defined in various Muslim law schools include Ariya or sadakah, in which a Muslim performs hiba as a religious duty in order to earn good acts and blessings from the deity. Hiba is defined by Hanafi lawyers as “an act of bounty by which a right of property is conferred in something specific without an exchange.” According to the Shias, a hiba is “an obligation by which property in a specific object is transferred immediately and unconditionally without any exchange and free from any pious or religious purpose on the donor’s part.”

In the case law of Noorunissa alias Pichamma v Rahaman Bi, it was stated by the learned counsel that the settlement of the money advanced by the gift donor cannot be stated as a gift by an individual according to the Mohammedan law.

In the case of Musamat Hazara Bai v. MD Aadani Sayed, the Hon’ble Court did not consider gift of life interest to be a valid subject matter.

However, in the case of Jamila Bibi v. Sheikh Ismail, Hon’ble Court allowed gift of life interest in the form of usufruct to be a subject matter of Hiba.

Later, in the case of Amjad Khan v. Ashraf Khan, the Hon’ble Court allowed the gift of life interest to be treated as a valid gift under Muslim Law.

In the case of Smt. Aneesa vs Abdul Rehman Rizwi (Imam), the Hon’ble court stated, “…subject matter of the gift is also important as the subject matter of the gift must belong to the donor and must be in existence at the time of the gift.”

PARTIES INVOLVED IN HIBA (GIFT)

In general, Hiba requires two parties, namely the donor and the donee; however, the donor can be two parties jointly supplying Hiba to the donee. The term “Donor” refers to an individual who lends out its property, whether mobile or immovable, as Hiba (gift), and the phrase “Donee” refers to an individual who receives Hiba (gift) from the Donor without any consideration in return.

REQUIREMENTS FOR DONOR

1. A donor must be compulsorily a Muslim.

2. A donor must be an adult i.e. a major while performing Hiba.

3. A donor must gift the property out of the free will.

4. A donor while performing Hiba should own the property under his/her name and there should not be any kind of fraud or any kind of adulteration. It should of free consent and will of one individual.

5. A donor can Gift (Hiba) to anyone, it can be a Muslim or from any other caste or religion.

REQUIREMENTS FOR DONEE

A Donee is a receiver of a gift who without any consideration receives the transfer of property.

1. The donee may or may not be a Muslim.

2. The donee may or may not be a minor.

3. The donee can be married or unmarried.

4. The does not need to pay any consideration in return of Hiba.

5. An unsound person or a minor may become a donee when the offer for any gift is made but to complete the hiba the delivery of the actual property is to be made to the guardian of the such unsound or minor person.

6. A dead person can never have Hiba in his name as donee. Muslim law strictly rejects hiba in the name of the dead person even though is made by the widow as meher.

7. A hiba can be made to the future unborn child whose interest is opened as a legal heir.

8. If the hiba is made jointly for more than one individual it stands invalid under Muslim law. But if the donees jointly share the possession of the property irrespective of the shares divided to each one then the hiba is valid and lawfully performed.

However, on any matter of dispute, burden of proof of the free consent of such Pardanashin women lays on donee as per Section 101 and Section 102 of the Indian Evidence Act, 1872. The importance of gift to be free from any compuslion has been upheld by the Hon’ble court in the case of Pasapini v. Moula.

There must be a share of donee specified and certain. If the property is undividable, the property may be jointly gifted. Any unborn person who is in the womb of a women, can be gifted with the property. In the case of Tagore v Tagore, the Hon’ble Court recognised child in womb to be a competent donee.

ESSENTIAL ELEMENTS FOR HIBA

Hiba is a broad idea with minute details encompassing the notion; to conduct Hiba correctly, one must obey its ground principles; below are a few aspects that make Hiba valid:

1. Declaration of Hiba (Gift):

Declaration of gift signifies that the person is practising Hiba willingly and without coercion or fraud. The gif confirmed for Hiba should be unambiguous and currently possessed by the giver. The proclamation of gift here refers to the performer’s free will and genuine intention.

According to the case law of Kamarunissa Bibi v Husaini Bibi, the court ruled that while declaring the property to the donee, the donor must have pure and honest intentions for the transfer of the property to the donee, with no sinister motive behind it. The hiba is not required by law to be registered or stamped.

2. Acceptance of Hiba

The acceptance of Hiba here alludes to the gift; once the declaration is made, the next critical stage is gift acceptance. Hiba’s acceptability Is to be made by the donee; when the donor proclaims its gift to the donee, the donee should say “Qabool” to make Hiba legal. Even if the hiba is registered, it is considered invalid if it has not been accepted.

The second most important factor is very well described by the Karnataka High Court in the case of Smt. Hussenabi v Husensab Hasan, in which the court held that the existence of all Hiba laws should be present when gifting a property under Muslim law in order for it to be a lawful agreement.

3. Transfer of Hiba

The declaration and acceptance are important, but the hiba is not complete unless the donor transfers the hiba to the donee. The hiba is said to be finished when the acceptance is completed and the donor transfers the property in the name of the donee with good intentions.The hiba is completed and regarded valid as of that date and time because it was provided and accepted by both parties, making it a complete deed.

The bench stated in the case study of Noorjahan v Mukhtar that once Hiba is made as the acceptance of such property by the donee but later on the profits are enjoyed by the donor till his lifetime is a voidable Hiba, as after the delivery of the property to the donee the benefits and perks are to be given to the donee as his share of the property.

There are two types of property transfers: actual and constructive delivery.

HIBA AND ITS KIND

- Hiba-bil-iwaz

Iwaz is a word that signifies “consideration.” Thus, Hiba-bil-iwaz refers to the exchange of goods for some consideration. As a result, it is an exchange transaction. The essentials of Hiba-bil-iwaz are as follows:

1. Hiba must be legal and full.

2. Execution of the transfer

However, the idea of Hiba-bil-iwaz is not recognised by Indian law.

- Hiba-ba-Shart-ul-Iwaz

Shart is a condition. As a result, the donor imposes certain conditions on the acceptance, which the donee accepts. The following are the characteristics of Hiba-ba-shartul-iwaz:

1. Possession must be delivered.

2. Irrevocable until the iwaz is paid in full.

3. Upon completion of the transaction, the character of sale is assumed.

- Sadaqah

Sadaqah is a religious transfer made to please the Almighty God. Sadaqah is any Hiba with a religious motivation. Once transmitted, it is irreversible. The three necessary conditions of declaration, acceptance, and transmission of possession must also be met. However, express acceptance is not a must.

- Ariyat

This type of gift is analogous to a landlord-tenant relationship in which the donee (Tenant) occupies the property until the landlord’s (Donor’s) will. This sort of Hiba does not provide the donee ownership; rather, it grants the donee access to the property for a specified time. The ariyat is a type of temporary Hiba that allows you to use its services, reputation, and facilities for a set amount of time in exchange for payment.

- Musha

The word ‘Musha’ comes from the Arabic word for bewilderment. It relates to the’saayu’ in Muslim Law, which means an undivided portion of the property. Thus, Musha refers to the property’s undivided portion or co-owned property. If one of these co-owners Hiba his property, confusion may emerge as to which portion of the property goes to the donee. Therefore. Musha doctrine is adopted to avoid such confusion.

- Musha of indivisible property: It includes properties that cannot be partitioned. Although such Hiba appears dubious on the surface, a gift of an undivided portion in a property that cannot be divided is lawful. In this instance, hiba without possession is legal.

- Musha of divisible property: Property that can be divided without altering its worth; the Hiba of such property is effective only if a particular share that has been gifted is separated by the donor and given to the donee.

The following are the doctrine’s exceptions:

- Co-heir (co-beneficiary) gift

- Zamindari gift to share

- Shares in landed companies as a gift

- Gift of a portion in a commercial town’s freehold property

REVOCATION OF HIBA

Revocation of Hiba before to transfer of possession is lawful, and the donee may withdraw the Hiba at any moment before delivery of possession. Hiba cannot be cancelled by the donee after it has been granted. However, the Hiba can be cancelled under two circumstances:

• by court order

• by donee permission

- Revocation under Transfer of Property Act 1882

A gift may be withdrawn under the following conditions, according to Section 126 of the Transfer of Property Act: That the giver and donee have agreed that the “gift” will be withheld or withdrawn in the event of a specific circumstance. The event should not be determined by the donor’s desire. That the criteria must have been acknowledged by both the donor and the donee at the time the “gift” was accepted.

- Revocation under Muslim Law

Before delivery of Possession – A gift is not valid until it is accepted in possession, and the donor has the unfettered and unrestricted right and ability to cancel it.

After delivery of possession– Even after the gift has been delivered in physical form, the donor has the option to cancel it with the donee’s agreement or by requesting a formal court order.

CONSTITUTIONAL ROLE OF HIBA IN INDIA

Article 14 of the Indian Constitution stipulates that everyone is equal before the law and that the law should not discriminate against anyone based on their caste, religion, gender, creed, or anything else. Article 14 declares, “Equality before the law.” Within the territory of India, the State shall not deny to any person equality before the law or equal protection under the law. Article 14 forbids any sort of discrimination based on breaching an individual’s rights and instead focuses on valid grounds of fair classification to give full justice.

It is clearly stated in the constitution that Article 14 focuses on the motivation of justice with all without any form of discrimination; it lays out its foundations for justice very clearly in the constitution that no justice will have prevailed if there is discrimination or a motive for discrimination in any particular situation. Article 14 takes effect when there is any reasonable ground in the situation; article 14 demands a clean and neat motive for it to take effect. For the article to be lawfully implemented, the reasonable ground must suit the goal of legislation.

It is apparent that Muslim law has numerous branches, each explaining Hiba and laws linked to it in different ways, but in the Indian court system, Mohamedan law and its interactions with Hiba come into force, since it is known that the Transfer of Property Act, Section 129 exempts Hiba from the Transfer of Property Act. The Mohamedan laws are derived from it, although the regulations and guidelines of article 14 are maintained to protect the Hiba law.

The most important aspect of Hiba is to proclaim Hiba to the donee as a wording expressing ‘I have given’ or ‘I have gifted’ according to the Hedaya: Hiba is described as a purposeful transfer of property to the donee on the part of the donor, with the property remaining his/her possession in exchange for no payment. This form of transaction is essentially pure intention and a manifestation of one’s genuine love for another.

CONCLUSION

The Transfer of Property Act of 1882 governs the transfer of property through gift. These regulations do not apply to gifts given by Muslims, who are governed by Islamic law. According to Muslim law, a person has the right to ‘donate’ all of their property belongings at any time during their lifetime. However, unlike The Transfer of Property Act of 1882, this gift takes effect immediately and absolves the sender of all control and ownership. Gifts might be given for no purpose at all or for a specific cause.

Shatakshi Vyas Email: shatakshivyas31@gmail.com

Indore Institute of Law