ABSTRACT

The Role of Law and Regulation in Sustaining Financial Markets is an inevitable and important part of social structure. This paper addresses the connection between law, financial development, and economic growth. It also deals with the role of financial laws and regulation, which can be used to correct market failures, such as negative externalities, information asymmetries, and monopolies. It essentially focuses on the design, functioning, and performance of different financial instruments while examining the topic of Corporate Social Responsibility.

KEYWORDS

Global Economic Crisis (2008), Enron, LTCM’s downfall, the Great Depression Financial Services Act 2010, The Banks Act 2009.

INTRODUCTION

In order to sustain social order, the law acts as a critical component. It is often believed to be synonymous with phrases such as justice, equality, freedom, and liberty. This demonstrates the understanding of the lay person on the concept of law and its purpose. Innumerable damages and fatalities occur in various systems throughout history because the broader role played by the law is often underestimated and misunderstood.

The question arises whether law merely plays the role of providing a simple set of instructions on how to operate in a society or is it the major structural pillar that upholds the arches of every system or institution in the social construct.

“This paper attempts to examine the various interpretations of the role played by law in the financial world, as well as examples of similar failures. This is to objectively identify the same type of correlations that is responsible for many of the major financial catastrophes in this century. This covers the 2008 Global Economic Crisis, Enron and LTCM’s downfall, and even the Great Depression. We take a look back to see how significant and fundamental legislation has been and will continue to be in our financial markets.” The goal of this research is to determine the extent to which legislation is absolutely necessary for the proper operation of the financial market. It also looks at how the lack of it may be a source of uncontrollable disasters.

RESEARCH METHODOLOGY

- Research Method: Qualitative analysis with Case study

- Scope of Study: This paper analyses if there is an inherent, inevitable pre-existing relationship between Law and Financial Markets. It also attempts to understand the extent to which this relationship goes and how much of a dependency is inherently existing in it. It questions whether an absence of such influence would cause negative effects by reviewing and understanding the major financial failures of the past century.

REVIEW OF LITERATURE

- Paper Citation: Professor Steven L SHWARTZ, The Role of Lawyers in the Global Financial Crisis, S Schwarcz, ‘Systemic Risk’ (2008)

To evaluate if the attorneys who oversaw the transactions and commercial operations of market participants were negligent or ignorant,

The Harmful correlation between events in History that led to Financial disasters and the indication of similarity of decisions and faults over the period of history despite recent and current developments. Lack of foresight and awareness despite last happening and no foreseeable preventive measures being taken.

- Paper Citation: Glinavos, Ioannis (2010) European Business Law Review, 21(4), pp. 539557. ISSN (print) 0959-6941

In the financial crisis, regulation and the role of the law are important. By demonstrating the persistence of market-centered conceptions that characterised the state-market relationship prior to the crisis, this research contributes to the present discussion over solutions to the crisis and the role of law in paving a road out of recession.

The article discusses the relationship between deregulation and financial crises, stating that there is a clear correlation between the state’s shrinking reach and market instability, citing parallels with earlier market failures such as the Great Depression.

ANALYSIS AND SUPPORTING DATA

“A sound legal and regulatory framework” ensures the stability and the success of financial systems and markets.[1] It is largely accepted that “financial systems cannot operate in a legal vacuum”. The system of law “defines property rights, allows for the exchange of property rights, and protects property rights”.

In accordance to this, conditions for loans is determined by organizations such as the IMF and the World Bank. It is done according to the country’s fulfilment of certain aspect such as rule of law, judiciary that is independent, free media and participatory politics, which is considered to be the basic requirements for the elementary institutional framework.

In this background, the U.K and its English law have turned into “the predominant choice of financiers and their lawyers as the law governing financial contracts”. The reason is mainly because English law “provide certainty in the rights and obligations of the parties, and predictability of the outcome in the event of legal disputes”2 Indeed, the presence of “law and regulation ensure that financial transactions are carried out within a clear, predictable and enforceable legal framework”. While, a dire consequence would be that “the entire financial system would collapse under the uncertainty caused in the absence of legal institutions”. In other words, “the legal and regulatory framework is significant for the strength and soundness of the financial system and the certainty of individual contracts and transactions”.

ANALYSIS OF MAJOR FINANCIAL COLLAPSES IN HISTORY

The great depression

Many banks were involved in the industry of margin lending to hazardous customers prior to the Great Depression. These loans were secured “by shares of stock purchased with loan

proceeds by the borrowers. The stock’s collateral value was initially equal to the loan amount, and the banks assumed that the stock market” would not collapse and that stock prices would continue to rise as they have in the past. Most bankers trusted this notion that there would be no significant fall in value.

In August of 1929, nevertheless, when an unanticipated price fall occurred in stocks. It caused under collateralization of these margin loans. The banks that were deeply invested in margin lending dealt so much loss that their institutions defaulted on their own debts[2]. This represented the first failure: a failure to foresee, or at least to fully comprehend the correlations between unlikely declines in collateral value and institutional integrity based on the regulatory laws and policies they had in place. The Great Depression also involved the second failure: when the correlations in financial institution interrelatedness were not foreseen, in this case the prevalence of interbank loans and other advances linking banks together financially. This combination of failures caused transmission of systemic shocks which made the Great Depression so devastating. As individual banks began defaulting because of margin-loan losses, their inability to repay interbank loans caused their creditor banks to suffer losses and begin defaulting, which in turn triggered a downward spiral of the banking system.

“Long-Term Capital Management

“Long-Term Capital Management (LTCM) was a hedge fund “of huge scale that profited by using arbitrage-related trading strategies. In 1998, however, LTCM failed to predict provisional market irrationality pricing of bonds and government bonds of Russia. LTCM therefore suffered a loss of about more than 100 million dollars thereby undermining its financial capability.4 This represented another failure that didn’t see the correlation between unlikely declines in collateral and investments.[3] LTCM’s failure also implicated the 2nd failure. Most market participants at that time didn’t see the strong correlation in financial institution interrelatedness between hedge funds and banking institutions, which were connected through derivatives-based hedging and the absence of regulation strategies within the institutions. The US Federal Reserve Board, however, realised that LTCM’s collapse could have devastating

consequences: LTCM’s derivatives-counterparty banks would suffer serious losses, potentially causing them to begin defaulting and triggering a downward spiral of the banking system. To avoid this downward systemic spiral, a settlement was brokered by the Fed to settle LTCM’s debts.

Enron

Enron’s main and very gainful business was engaging as a derivatives counterparty. To continue in this business. The investment-grade rating of Enron needed to be preserved. The drop in value of the Enron’s so called ‘merchant assets’ was the major risk that was anticipated. Enron had to mark down and market their asset values as a result of this. Enron participated in a series of structuring transactions to safeguard its credit rating by making optimal use of the company’s equity. “As collateral to hedge the value of the merchant assets, Enron’s shares saw a record surge in the public market price. However unanticipated move the price of Enron stock fell down substantially thereby triggering a collapse in the hedging structure and a downgrading of Enron’s rating investment grade. Enron had to file for bankruptcy as it had lost its main business strategy. Collapse of Enron didn’t trigger broad systemic consequences. As Enron’s collapse was not associated with other institutions in the finance sector as some of the other financial institutions have carefully and prudently drafted laws in place that prevented such collapse.”

The Recent Global Financial Crisis-2008

Mortgage lenders gave risky loans to borrowers of uncertain nature during that period. The homes that the borrowers purchased secured these loans. These homes were bought with the loan proceeds. The intricate asset-backed securities’ payments which were sold to banking institutions and investors of other institutions were partly supported by the collateral of the grouped together subprime mortgage loans. The maintenance of the value of these securities were reliant on home prices and their appreciation, as they had been increasing for decades. But market participants may have been too myopic and too conflicted to envision that home prices, and thus collateral values, could fal1.6 However in 2006 house prices fell in the United States of America and Europe. This caused a huge drop in housing prices all over, mortgage

“6 S Schwarcz, ‘Regulating Complexity in Financial Markets’ (2009) 87 Wash U L Rev 211 at 216-20 (observing that although these (ABS CDO) securities were backed by what appeared to be significantly diverse assets, there was an underlying correlation in the subprime mortgage loans backing many of those securities).”

defaults. It also led to credit markets becoming chaotic, that caused some European countries to become debted and receive emergency fund. Due to falling prices of housing, it led to defaulting of the asset-backed securities, it caused financial institutions who were heavily involved in these assets to write down their value, making them appear. If not actually be, financially dangerous. The financial crisis also involved the second failure: a failure to see correlations in financial institution interrelatedness, in this case both the strong interrelatedness between not just banking institutions but also non-banking financial institutions (such as Bear Stearns, Lehman Brothers, and AIG), as well as a failure to see the strong interrelatedness between financial firms and markets causing systemic shocks and ripples. As counterparty risk increased, dealing between financial institutions stopped, dipping the accessibility of credit. Likewise, due to the defaulting of securities backed subprime loans, there was a drastic reduction in investment in those particular types of securities and other securities backed by different types of collateral by investors in those securities and also securities backed by other types of collateral drastically reduced. That also contributed to the reduction in the accessibility and availability of credit. And the unavailability of credit devastated the real economy.

Financial analysts suggest that such an instance wouldn’t have occurred if laws limiting and regulating the estimation of collateral value were in place in all banking institutions. It would have prevented the overestimation of collateral value that caused the domino effect of the events occurred consequentially. Its effect rippled through all countries causing a global economic and financial downfall.

RESULT AND GRAPH ANALYSIS

The above analysis clearly illustrates how the absence of regulatory laws in financial market or its ineffective enforcement led to devastating consequences.

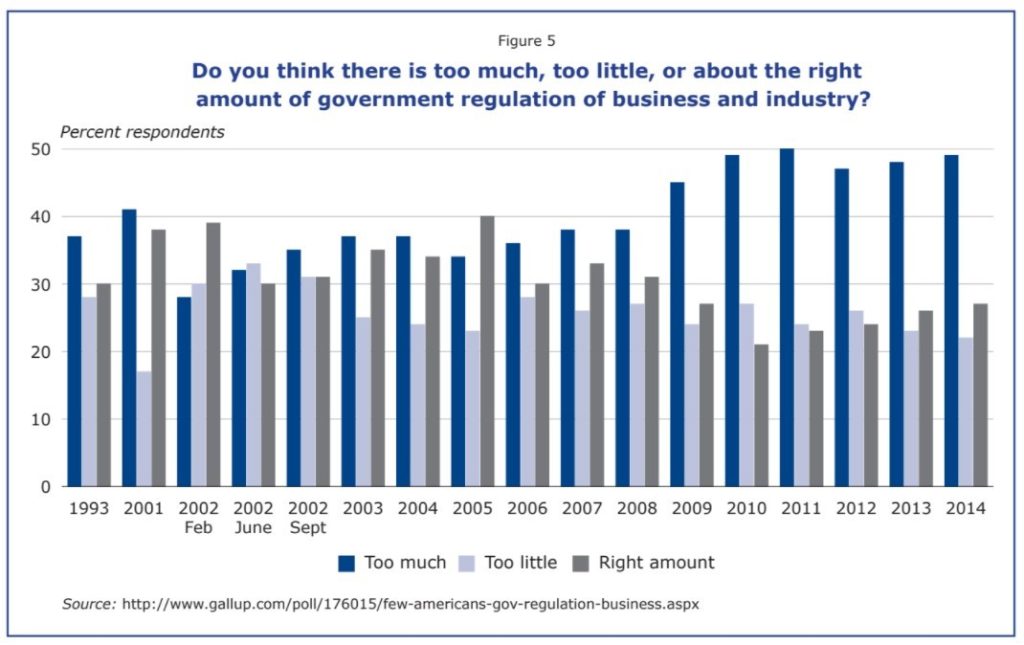

This graph indicates that there has been a subsequent large increase in regulatory laws and policies after the Global Economic Crisis of 2008 which is currently ensuring the smooth run of the financial market in the past decade, even in the present turbulent situation of the covid –

19 pandemic, there hasn’t been a collapse of the market in accordance to the enormous magnitude of the pandemic. This relatively smooth functioning can be attributed to the newly introduced regulatory laws and its better enforcement that are upholding the market.

The laws act as that nuts and bolts by determining the ease with which a business can be opened and shutdown, the efficiency that accompanies the enforcement of contracts, the administrative rules relating to a variety of activities which include acquiring an electricity permit and performing the paperwork for exports and imports. These nuts and bolts of the system and the market – The Law, are seldom visible in the limelight, but they play a critical role. The malfunctioning of Law can spoil the progress of the financial market and can make the financial instruments less effective.[4]

Banks require to be supervised and regulated to some degree to ensure the safety and the stability of the banking system. In this context, the Financial Services and Markets Act 2000 (FSMA 2000) was passed by the United Kingdom. It authorized super-regulation for the whole financial services sector by the Financial Services Authorities (FSA). It aimed to provide responsibility for the regulation and supervision.

However, the global financial crisis of 2008-2009’s banking difficulties couldn’t be addressed with this regulatory system as it was not suited for it.

The regulatory structure in existence during the global financial crisis appears to be the primary cause of the system’s vulnerability. mostly due to the regulatory framework’s flaws at the time Following the crisis, the focus of legislation and regulation shifted to maintaining financial stability and deterring misbehaviour.

The Banks Act 2009 was supposed to address the gap in dealing with pre-insolvency’ stabilization’ and banking insolvency and administration.

The next year, the powers of FSA were strengthened by the Financial Services Act 2010. It provided a ‘financial stability’.[5]

Meanwhile, emerging economies of Mexico and East Asia also suffered financial crises. While an indispensable role is played by law in their financial policy, before implementation of rigorous financial regulations it is required that a robust legal system is in place. Analyzing the financial crises of Asia, the feeble frameworks of law and regulations, i.e., “the inappropriate sequencing of financial deregulation and liberalization, and the lack of prudential supervision of the financial system, were the important factors contributing to the Asian financial crisis.” The importance of supervision was highlighted. “Capital markets need supervisory and regulatory structures in place before broad-based financial deregulation and liberalization are introduced.”[6] In other words, “a developing and maturing legal system can reduce the

likelihood of a financial crisis”, Confidence and stability for a market economy would be brought by a well-developed legal and regulatory framework and it would help it thrive.

Varying degrees of legalization were aimed by the New International Financial Architecture- NIFA’s informal bodies of the state, networks of different networks, privately owned industries and organizations in response to the 1990s financial crisis. They wanted to develop economies that possessed sound financial systems. There is a need for reformation of banking sectors of developing countries that are regulated improperly, to be similar to their more progressive counterparts.

An informal forum which is state to state was established due to the creation of the Group of Seven (later the Group of eight). A yearly meeting is held between the government heads of the eight largest economies. The emergence of global standards for financial regulations is the ultimate goal for which steps are taken to enable that process. The Basel accords on capital adequacy were amended by the Basel Committee. The adoption of the Basel II agreement within the framework of the NIFA occurred in 2004. [7]

SUGGESTIONS

After our understanding and what we have illustrated in the paper, we believe that Bank regulators should perform four functions that help to strengthen and maintain trust in the banking system—and trust is critical to a functioning system.

First, they must examine banks’ safety and soundness. Second, they should make sure the bank has adequate capital. Third, they must insure deposits. Fourth, they should evaluate any potential threats to the entire banking system.

This reiterates the role played by law and how it will continue to play an indispensable role in the years to come.

CONCLUSION

The analysis and the data point out that law has a much deeper reach in our financial system than anticipated. Smooth functioning of the financial markets mandate the requirement of a of strong system which emphasises the importance of effective regulatory and protection laws. A legal and regulatory framework establishes sound financial health for a country thereby also curbs any ripple effects that would have been caused if any financial collapse or event had occurred[8]. This goes on prove that how in today’s day and age with world entirely functioning through globalization, a lapse in a single country or city can cause large effects everywhere else in the world. This reiterates the importance of strong laws governing the global financial market for the protection of all economies making up the global economy. This establishes that law plays an integral and inevitable role in a successful financial market.

REFERENCES:

- Meckling, W. H. (1977). Financial markets, default, and bankruptcy: the role of the state. Law and Contemporary Problems, 41(4), 13-38.

- Arner, D. W. (2007). Financial stability, economic growth, and the role of law. Cambridge University Press.

- Calomiris, Charles W. “Financial factors in the Great Depression.” Journal of Economic Perspectives 7.2 (1993): 61-85.

- Stiglitz, J.E., 1993. The role of the state in financial markets. The World Bank Economic Review, 7(suppl_1), pp.19-52.

- Stiglitz, J.E., 1989. Financial markets and development. Oxford Review of Economic Policy, 5(4), pp.55-68.

- Azman-Saini, W. N. W., & Law, S. H. (2010). FDI and economic growth: New evidence on the role of financial markets. 107(2), 211-213.

- Stiglitz, J. E. (1993). The role of the state in financial markets. The World Bank Economic Review, 7(suppl_1), 19-52.

- Moloney, N. (2014). EU securities and financial markets regulation. OUP Oxford.

| ▪ | Black, J. (2013). Reconceiving financial markets—from the economic to the social. Journal of Corporate Law Studies, 13(2), 401-442. MANAV RAJPAL B.B.A.LLB (HONS) NMIMS, BANGALORE 11 |

[1] Centre for Financial and Management Studies.. (CEFIMS), 2013. financial law, Units 1, pp.10, 3 London. “2 Centre for Financial and Management Studies (CEFIMS), 2013. Financial Law, unit 2, pp.8-9”

[2] S Schwarcz, ‘Systemic Risk’ (2008) 97 Georgetown LJ 193 at 199-200, citing M Bordo, et al, Real Versus PseudoInternational Systemic Risk: Some Lessons from History 21 (Nat’l Bureau of Econ Research, Working Paper No 5371, 1995. 4 R Lowenstein, When Genius Failed: The Rise and Fall of Long-Term Capital Management, Random House, New York, 2000, at 144-6, 164, 169-70.

[3] LTCM failed to take a long-term view of arbitrage risk, not dissimilar to how banks prior to the Great Depression failed to take a long-term view of collateral risk.

[4] The World Bank’s senior vice president and chief economist, Kaushik Basu

[5] Ellinger, E, Lomnicka E & Hare C (2011), ‘Ellinger’s Modern Banking Law’, Oxford University Press.

[6] Walker, J L (2000), ‘Building the Legal and Regulatory Framework’, Building an Infrastructure for Financial Stability, Conference Series No. 44, (E S Rosengren & J S Jordan eds.), paper presented at the Conference of the Federal Reserve Bank of Boston, June

[7] Turk, M C (2014), ‘Reframing International Financial Regulation After the Global Financial Crisis: Rational States and Interdependence, not Regulatory Networks and Soft Law’, Michigan Journal of International Law, Vol. 36, Issue 1. http://repository.law.umich.edu/mjil/vol36/iss1/2

[8] Centre for Financial and Management Studies (CEFIMS), 2013. Financial Law, Units 1 p.18